Experts give their take on the future of the credit industry post COVID-19

While Skype and Zoom become the new office, we had the great pleasure to interview two titans of the credit industry; Paul Randall – Global Markets Director at Creditinfo Group, and Oscar Madeddu, Senior Advisor at IFC, World Bank. With a new reality unfolding through disruption of to our daily life, we felt the necessity to ask the veterans of our industry what the future could look like in a post-COVID society. We asked our interviewees to share ideas on how the crisis will impact economies, credit, credit reporting and what authorities around the world are and should be doing to safeguard borrowers, lenders without endangering the integrity of credit reporting databases.

Paul: Covid19 wasn’t just a humanitarian crisis but also disrupted financial markets like no other crises before. If we look at its economic impact, we see that compared to the 2 previous historical major crises of 1930 and 2008, there has been a double and unprecedented economic shock: both of supply and demand. This in addition to the uncertainty and lack of visibility due to the open-ended nature of the pandemic, massive dips in GDP, a tumbling of oil prices, a repositioning of global supply chains affecting emerging markets, and an inevitable decrease in remittances, just to name a few negative factors. This perverse combination will disproportionately affect all markets but above all, developing countries. What are the responses that have been put in place worldwide? Has the World Bank Group been engaged? How? And what is the forecast?

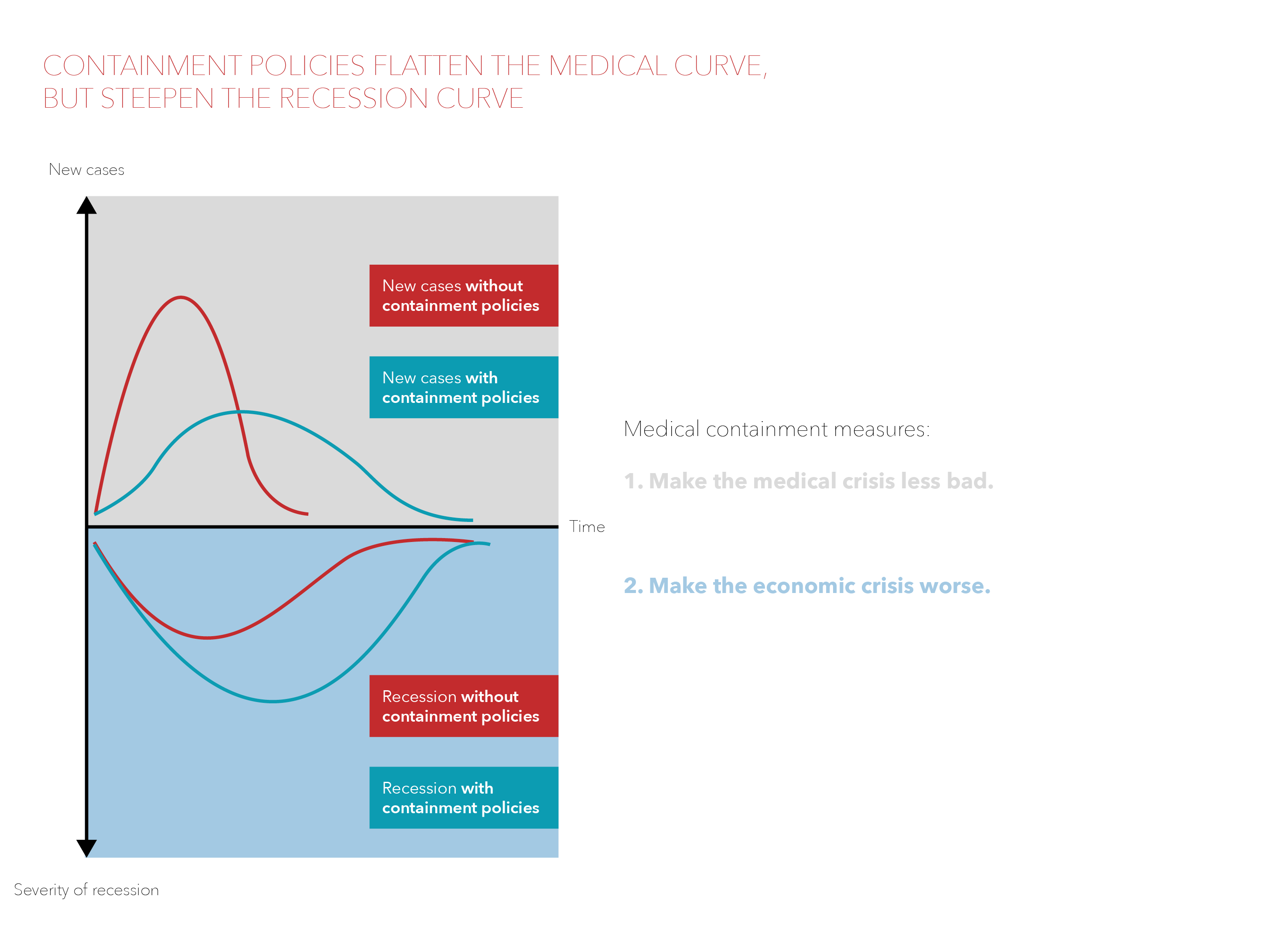

Oscar: You are totally correct Paul, the COVID-19 pandemic has thrown developed and developing countries alike into a crisis of unknown severity. The paradox is that the more is done to solve the health emergency the deeper becomes the economic problem, and measures to contain the pandemic contribute to sharp declines in the economy (see slide).

The IFC has been collecting data in the past months which show how severely the economic crisis hit the already fragile economies. Only during the first 2 months of general confinement, we observed:

- a large selling of government bonds,

- a 20% average currencies depreciation vs. the USD,

- a generalized downgrading of sovereign and corporate debt by the major rating agencies,

- an increasing and general delay in repaying sovereign debts,

- and a future significant drop in Foreign Direct Investment can be predicted

In the regions where I mostly work, MENA/SSA, we, unfortunately, register more than a double shock, I would rather say that it is an “accumulation of shocks”, as the pandemic is just the last straw after oil depreciation, conflicts and civil wars underway, millions of refugees stranded in inhospitable sites, health systems unable to cater for all those in need, tourism decline, etc.. Regrettably, not an exhaustive list.

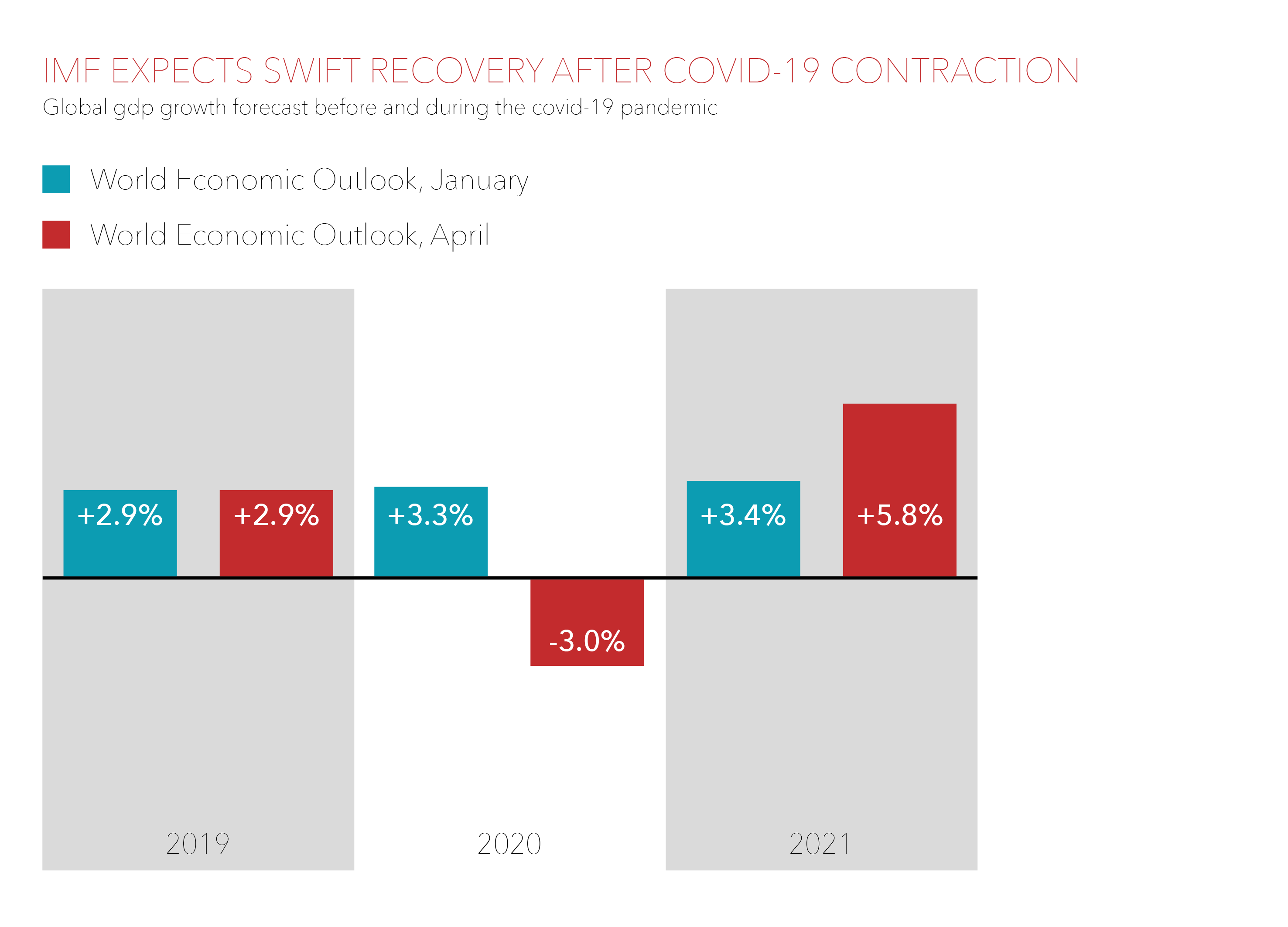

The macro-economic projections are unfortunately not rosier: COVID will spare no country and no economy, based on recent IMF’s forecasts on 2020 GDP, markets will show the worst overall performance decreasing globally by 3 %. Some countries will drop by 7% – 9% regardless of the market being developed or developing. In Italy for instance, my country, GDP will plummet by more than -9%.

That said there should be an immediate positive response in 2021, with the global GDP growing by 5.8%, with those countries mostly hit in 2020 showing the best performance.

But that is the future. Today, over 180 countries are suffering this double shock you mentioned. Governments and regulators are called to give responses on several fronts: health emergency of course, but also safeguard the economy, protect social harmony and answer the increasing poverty call. The WBG has immediately put in place a crisis response program with structural interventions, supporting institutions in more than 140 countries. Roughly US$ 160 billion will be disbursed. In addition, supplementary funds have been immediately apportioned for a rapid response to the emergency on programs aimed to protect the poor, MSME, informal and vulnerable people, support families, health and sanitation projects, unemployment benefits, social insurance, cash transfers, subsidies, etc. etc.

Paul: One of the obvious consequences of this deep and probably long-lasting economic crisis is the tremendous impact on the ability of debtors to respect their loan payments, and possibly a credit crunch with a more severe impact for the more vulnerable sectors. We have seen that many governments have put in place loan payment holidays or similar measures. What will the likely impact be on credit markets? What can we expect?

Oscar: The scenario you are mentioning, I am afraid, is going to be the unfortunate reality. Since we all went through a financial crisis before, we know that one of the quite disturbing consequences is the unintentional incapacity of countless borrowers, households and companies alike, to repay their debts, mortgages, credit cards, overdraft accounts. Let’s take for example MSME. In MENA, 96% of companies are MSME, and they account for over 50% of jobs. In Africa figures are similar, as well as in Asia and LAC. Most of them are fully informal (no-file or thin-file borrowers) and access to credit is the main, huge problem they face, because of their opacity, because of lack of collateral and especially because of lack of credit histories. Based on IFC’s analysis, even before the COVID, the gap between loan demand and offer to MSME in the MENA region ranged between US$ 165 – US$ 200 billion or 84% of total demand. We can only ask ourselves how this situation will deteriorate because of the COVID? What can be done so that these borrowers are not unnecessarily penalized, and their lives jeopardized?

The litmus test, to appreciate the magnitude of the problem we face, is to analyze data and statistics about the activity of some credit bureaus, around the world. Scores of webinars, analysis, notes, statistics, have been produced in the past months by credit bureaus like yours. I personally made a survey to understand whether information providers around the globe did experience any decrease in the volumes of inquiries and how statistics look alike, after 4 months of confinement. The findings are self-explanatory, and reflect the path that marked other crises:

- There is a global, general, systematic decrease of inquiries to credit bureaus in all countries and all regions. This is troubling because, as we all know, an inquiry to the credit bureau normally triggers a new loan origination.

- More worryingly, the drop oscillates between 20% and 80% depending on countries, weeks of confinement, and dates of confinement.

- We can infer that this decline mainly corresponds to the same number and/or volumes of loans not granted, not renewed, not refinanced, etc. (though a small physiological percent of them would have been rejected even in normal times).

- Statistics clearly show both number of new loans granted, and outstanding volumes plunging.

- The problem becomes more acute as the weeks go by, the confinement becomes stricter, and the number of inquiries plummets.

- All financial sectors struggle in the same manner: banks, MFIs, NBFIS.

- The loan typologies more impacted and showing the highest decline in approvals are those generally made available to the most vulnerable segments of the population (pay-day loan, very short-term loans, cash loans, etc.) which often represent survival.

- The average debt age increases, as well as the indexes showing the worsening health of businesses and companies.

- Expected ratios of NPL, LGD, PD etc. are on the rise because of the impossibility to repay debts which many borrowers find themselves trapped in, even though against their will.

Personally, I do not think all this is going to vanish in a matter of 3-6 months.

Paul: Will there be consequences for Credit Reporting? What is the impact of generalized non-payment for the global information sharing industry? And what can be the consequences?

Oscar: Unless a concerted effort is made by regulators, governments and international bodies, to protect the quality and the exhaustivity of credit reporting, the reliability of the data and therefore the beneficial impact that credit histories can have on financial inclusion, systemic risk control, the decrease of collateral and operating cost, can be seriously deteriorated to the disadvantage of existing and future potential borrowers.

To this end, in the past months, we have witnessed different reactions from different authorities in different countries and I must say that in most cases the actions taken have safeguarded the integrity of credit bureaus data. In a few cases though, solutions looked potentially detrimental to the integrity and completeness of credit reporting (e.g. like erasing bad payers from databases or totally forbidding the periodical update of loan accounts from lenders to credit bureaus or public credit registries).

Interestingly the ICCR[1], chaired by the World Bank, and participated by regulators of many regions, issued a very clear policy recommendations document in April (“Treatment of Credit Data in Credit Information Systems in the context of the COVID-19 pandemic”), which lays down the correct guidelines to preserve the integrity of credit reporting, and the opportunities for the future potential borrowers.

In its note, the ICCR states that:

- The non-correct processing of credit data during a crisis has a potential impact on the integrity of the credit reporting system and ultimately the financial markets.

- Non-exhaustive and unreliable data reduces lenders’ reliance on credit reporting and can lead to:

- credit rationing,

- increase in the cost of credit,

- higher rejections of borrowers

- COVID -19 will affect good borrowers’ ability to meet their credit payments relegating them to the same level with existing non-performing borrowers.

- Therefore, there are raising concerns from regulators and governments on how data should be reported in the credit reporting systems.

- The discussion is therefore focused on how missed or delayed payments should be treated by credit reporting systems (both PCB and PCR), particularly on whether payment delays caused as a result of COVID 19 should be reported, how, and when.

Paul: Interesting, yes, I have seen the ICCR guidelines, we in Creditinfo were quick to work with banks to provide data that reflects payment holidays in our markets. Then, what are then the guidelines that should be implemented to strike a proper balance between credit reporting best practice and the problems created by the COVID? Are there any defined international standard? Does the WB chaired ICCR suggest a solution?

Oscar: Again, I would suggest reverting to the ICCR’s policy document. In fact, besides analyzing the impact that the artificial alteration of data quality/exhaustiveness may have on lenders/borrowers, on credit risk management practices, and on the predictive power of scoring systems, the document also suggests an honorable compromise on how to maintain credit reporting best practices also in the time of an emergency, mainly summarized as follows:

- Negotiation of loans forbearance periods and payment holidays between lenders and borrowers,

- Regular sharing of full file data (including negative credit data, unpaid installments, and positive data) with the necessary measures that safeguard the borrowers’ credit histories (e.g. flags, codes, indicators),

- Consistent interpretation and application of data reporting requirements across jurisdiction/sectors,

- Adequate business continuity procedures to guarantee full borrowers’ services (including complaints/ disputes),

- Enhanced borrowers’ digital access to free credit reports and scores during the crisis, where possible,

- Enhanced regulators’ capacity to handle complaints and disputes, due to their likely increase,

- Improved regulatory programs from authorities about consumer awareness and financial literacy,

- Measures to ensure minimal / no effect on borrowers’ credit scores (due to negative reporting / no reporting).

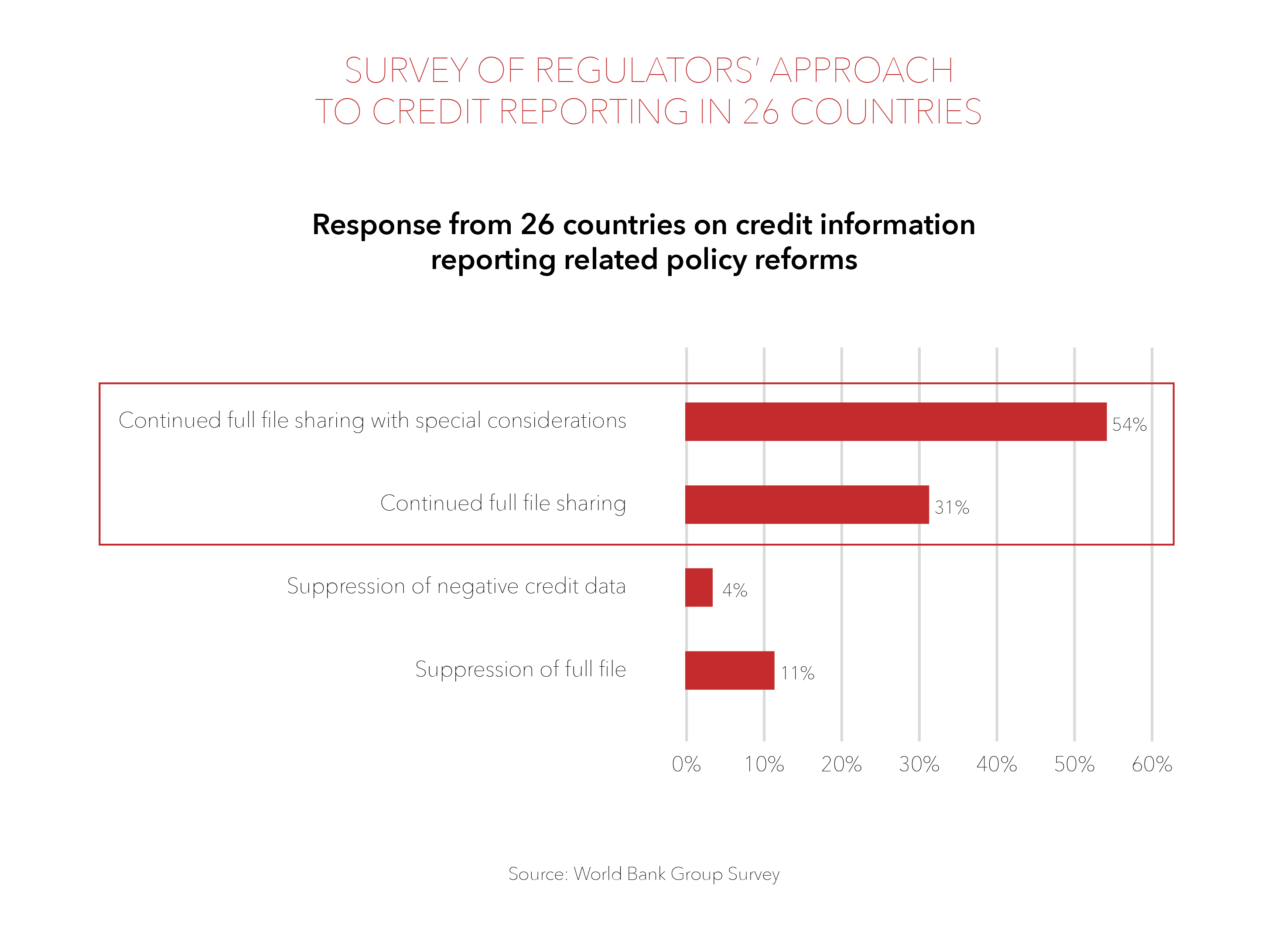

A World Bank recent survey recently made in 26 countries where credit bureaus are present show that the vast majority of regulators have adhered to the ICCR recommendations and in 85% of countries credit information is business as usual with the addition of some kind of indicator (code or flag) in roughly half of the country surveyed, as indicated in the figure.

All of the above, in my opinion, represent sensible, proper measures, which can preserve the integrity and reliability of bureaus databases, and to which I would think another few recommendations might be added, like:

- Banks scoring system will have to be constantly and unfalteringly monitored and eventually fine-tuned, to make sure that their predictive power holds despite the changes in the economic juncture.

- Credit policies and rules should be reviewed and tailored to the inevitable crisis consequences, and new commercial strategies prepared for when, in a future phase, demand for credit will become again the driver of the economy.

- The micro-finance industry should be supported and shielded. MFIs are the weakest link in the chain, and most vulnerable sector. They lend to the most vulnerable clients and generally funding their activity through bank loans. Regulators shall make sure that MFIs continue to receive their lifeblood even in a situation where many of the MFIs’ clients will be inevitably unable to temporarily repay their loans.

- In many developing markets in Africa, MENA and other regions credit bureaus have not yet been established. It goes without saying that also the public credit registries operated by the central banks should follow the same logic and guidelines indicated by the ICCR.

- Analyze, analyze, analyze. Information is the base for comprehension. Credit bureaus, where they do operate, can supply regulators with all the data necessary to study, research and control this unpredicted phenomenon. Data can help regulators to prepare reliable analyses for the Central Bank management, for the government but also can be used to strengthen forecasts, define regulatory measures, estimate projections for the government, banking association etc..

- We need to understand that the time for retrospective checks is over. The new international regulations (e.g. BASEL II -III, IFRS9) request central banks to shift from damage control to risk-based supervision, monitoring and forecast. This cannot be done without the constant analysis of granular data, and advanced analytical tools.

- Avoid erasing bad payers from the database. It is not a useful solution as it spoils the quality of databases, biases the power of predictive scores, and it is not fair to good payers. Also, suspending the transmission of data to credit reporting agencies will carry the same consequences. As mentioned, there are ways to safeguard borrowers in temporary difficulty without penalizing their credit history.

- Regulators shall maintain constant reciprocal contact with the credit bureau, which is their main support and ally, request statistics to understand where the market is going, anticipate problems, and find common solutions.

- Frauds are surging. Widespread remote work increases the opportunity for criminals to gain control of data that, before, was almost unassailable. The emergency increases the prospect and the likelihood that data is hacked. We hear every day new cases of data theft, forgery, misuse like COVID-19 tax rebate scams, crowdfunding scams, fake medicines sales, on line-sales scams, Accounts Take-Over, e-commerce and e-mail scams, fake charity requests, Phishing or malicious e-mails aimed at capturing user’s data (e.g. passwords, credit card numbers), or pharming (fake websites), vishing (voice calls), smishing (text messages attack), etc. We need to double up our attention and care while working from home.

- And this brings me to close with a consideration on new data and new financial technology to facilitate servicing borrowers and clients. One of the lessons we all learnt from COVID regardless of our industry or sector is that those countries and lenders with an advanced Digital Financial Agenda, have coped better and quicker with the emergency, by implementing rapid response measures: digitally paying cash subsidies and social contributions, allowing on-line loans applications, allowing withdrawals without cards, or just granting small loans via mobile telephone.

Paul: Any final insight? Any recommendation that might be helpful to the credit industry operators, the regulators, and all the stakeholders that operate in the vital credit industry sector?

Oscar: Well, I would not dare to be so pretentious to give seasoned risk managers and regulators in the frontline of this crisis any recommendations. They know better. Perhaps sharing some reflections on the importance of data quality is however imperative.

As for data quality, I think it is important to have one clear concept in mind: the quality, veracity reliability, but above all the correctness exhaustiveness and completeness of information, is undoubtedly the responsibility of the lenders/information providers (banks, MFIs, NBFIs, utility providers, etc.). The credit bureau is only a collector, a notary. Of course, the latter will have to ensure through sophisticated technology that the data is cleaned, purged, validated, and merged. Nevertheless, it is important that lenders understand that they have a huge responsibility in providing the correct and complete data, more than ever during the emergency. Accuracy, quality, timeliness, sufficiency, completeness and controlled obsolescence of data are among the World Bank’s fundamental Credit Reporting Principles.

For example, in many countries, ad-hoc credit reporting laws establish that lenders are mandated to provide complete data to the credit bureaus; however, it is often happens that not all data providers oblige, or do not provide data completely and thoroughly. It is important to understand that a credit bureau is established for the common good and that even one single financial entity which does not comply with the law jeopardizes the whole industry, its peers, and the good borrowers. Regulators should verify that data providers (and officers) do comply with laws, regulations and best practices, and should sanction those who are no compliant.

Maintaining a country’s systemic risk under control is both, a quite a difficult task and a huge responsibility. The credit bureau is the main tool that regulators have at their disposal to make it happen. Lenders/data providers have an important responsibility always but particularly during this emergency period: maintaining the overall quality and quantity of data unaltered and unmatched. Regulators, on the other hand, have the responsibility to make sure data providers comply with the engagement rules.

I hope that the COVID, as it came, will be gone, hopefully soon. It will not be forgotten easily, and it will definitely leave some scars on the industry, introduce enduring changes, teach us lessons about new technologies utilization, power and importance information, alternative data and tools, new risk management ideas, and certainly new frauds. Nevertheless , I am convinced that, as it happened after other major crises, we will heal the scars, raise again, and continue. As my Latin ancestors would say: nulla tenaci invia est via (for the tenacious, no road is impassable). Not even COVID. Thank you for the chat.

References;

[1] International Committee for Credit Reporting: http://pubdocs.worldbank.org/en/972911586271609158/COVID-19-ICCR-Credit-Reporting-Policy-Recommendations-for-distribution-6346.pdf– April 6, 2020